Overview

Regulatory Risk and Compliance: Global Expertise With a Regulatory Focus

Regulatory Risk and Compliance: Global Expertise With a Regulatory Focus

To meet regulatory requirements, enterprises must build an ecosystem of compliance with the systems and processes to support it, including data analytics, flag development, reporting and self-serve compliance analytics. Xoriant offers a wide range of advanced industry solutions and frameworks to ensure you stay ahead of the compliance curve.

- Data acquisition, modeling, profiling, quality assurance, reporting, data lakes/marts, operational data stores, regulatory reporting.

- Data lineage and analytical and MIS dashboards showcasing data sourcing and quality metrics.

- Coverage: (Global): Basel III, Liquidity, BCBS239, Dodd-Frank, FATCA/CRS, EMIR, MiFID, MAS, etc.

- Regulatory validations include OCC, D Fast, EMIR, FRB, LRR, etc.

- Extensive expertise with FR Y14 A, FR Y14 Q, FR Y14 M, all schedules and products e.g. AFS, MacCracken, DataScan, etc.

- Automation of analytics and reporting workflows.

What we do

Our Technology Services and Domain Competency

Regulatory Reporting Solutions

Regulatory reporting solutions to comply with global regulatory and reporting requirements such as BASEL III and CCAR.

Risk and Compliance Solutions

Risk and compliance solutions (AML, KYC , Sanctions) to help ensure regulatory compliance, while safeguarding against fraud and risk.

Data-Driven Approach

AI and analytics-centric solutions enable banks to automate regulatory validations and reporting, improving compliance and time to market.

Robotic Process Automation

Robotic process automation in front, middle and back office operations to reduce staffing and operational overhead.

Keeping You Updated

Regulatory, Risk & Compliance - Questions frequently asked

What does Xoriant offer for regulatory compliance in financial services?

Xoriant provides automated, scalable solutions to manage evolving financial regulations effectively.

How does Xoriant help reduce compliance risk?

Xoriant integrates AI-driven monitoring, reporting, and analytics to detect, prevent, and manage compliance risks.

Can Xoriant support global regulatory frameworks?

Yes, Xoriant enables compliance with global standards like Basel III, MiFID II, GDPR, and more across jurisdictions.

How does Xoriant simplify audit readiness for financial firms?

Xoriant ensures centralized documentation, real-time tracking, and audit-friendly dashboards to ease compliance reviews.

Disruptions becoming a blocker to your Desired Digital Future?

Let’s address them with Digital Engineering

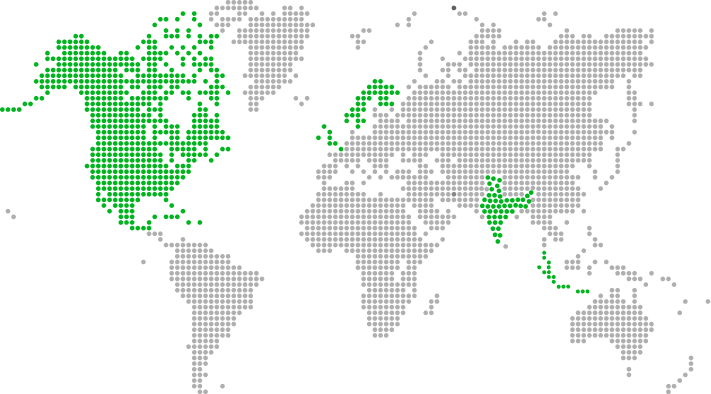

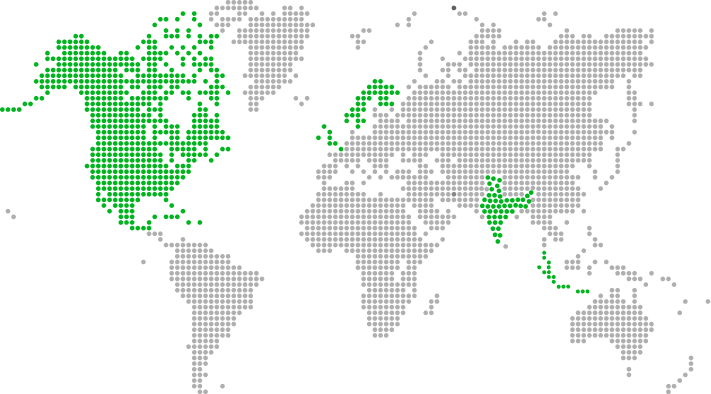

Globally Presence

Across Americas, Europe, and Asia

All Locations

Asia

Europe

North America

19 Locations

7

10

2

10 Locations

Ahmedabad

A-201, WestGate Business Bay, SG Road, Makarba, Ahmedabad 380015

Hyderabad

Block –B, Wing 1, 2nd Floor, Cyber Gateway, Hitech city, Hyderabad 500081

Gurugram

2nd Floor, Tower B, Unitech Cyber Park, Sector 39, Gurugram 122001

Singapore

70 Shenton Way, #13-03, Eon Shenton, Singapore 079118

Bengaluru

Subramanya Arcade SA Tower, 2nd floor, A-wing, Bannerghatta Main Road, BTM Layout, Bengaluru, Karnataka 560029

Chennai

8th Floor, Smartworks, Olympia National Tower, Block 3, A3 and A4, North Phase, Guindy Industrial Estate, Chennai 600032

Pune

7th Floor, IT-7 Building, Qubix Business Park Pvt. Ltd. SEZ, Phase - 1, Hinjawadi, Pune 411057

Mumbai - Thane

AWFIS 1st Floor, Nehru Nagar, Wagle Industrial Estate, Thane West, Thane Maharashtra 400604

Mumbai

7th Floor, Smartworks, Times Square, Tower C, Andheri Kurla Road, Marol, Andheri East, Mumbai 400059

Pune

6th Floor, Smartworks, Pan Card Club Road, Baner, Pune 411045

2 Locations

London

c/o SPACES, 12 Hammersmith Grove, London W67AP, UK

Ireland

Grove, Fethard, Co. Tipperary, E91 E282, Dublin, Ireland

7 Locations

Canada

55 York Street, Suite 401 Toronto, ON, Canada M5J 1R7

Mexico

Tomas A. Edison 1510-201 Ciudad Juárez, Chihuahua, Mexico 32300

Seattle

4030 Lake Wash Blvd NE, STE 210, Kirkland, WA 98033

Troy

6915 Rochester Road Suite 300 Troy, MI 48085

Sunnyvale

1248 Reamwood Avenue Sunnyvale, CA 94089

New Jersey

343 Thornall Street Suite 720 Edison, NJ 08837

Dallas

5851 Legacy Circle Suite 600 Plano, TX 75024

All Locations

19 Locations

7

10

2

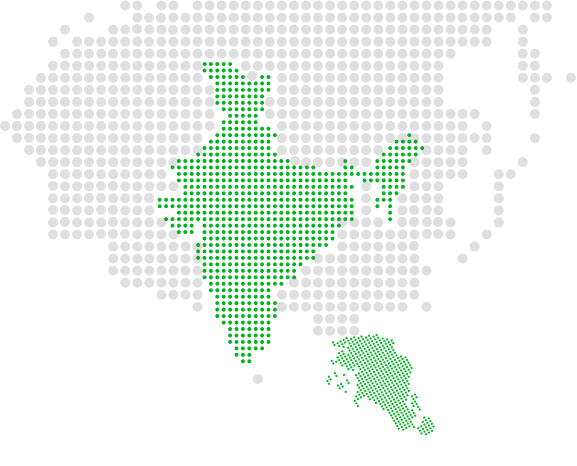

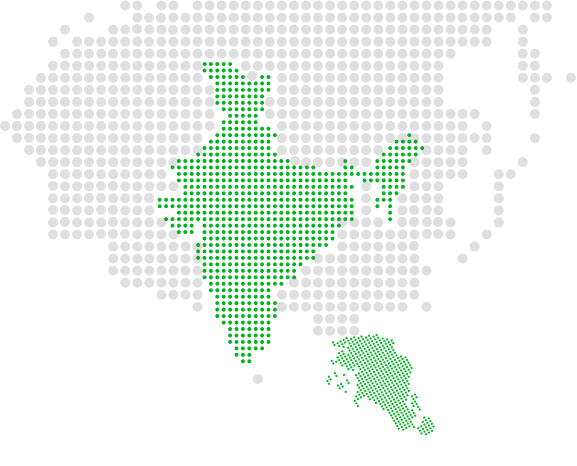

Asia

10 Locations

Ahmedabad

A-201, WestGate Business Bay, SG Road, Makarba, Ahmedabad 380015

Hyderabad

Block –B, Wing 1, 2nd Floor, Cyber Gateway, Hitech city, Hyderabad 500081

Gurugram

2nd Floor, Tower B, Unitech Cyber Park, Sector 39, Gurugram 122001

Singapore

70 Shenton Way, #13-03, Eon Shenton, Singapore 079118

Bengaluru

Subramanya Arcade SA Tower, 2nd floor, A-wing, Bannerghatta Main Road, BTM Layout, Bengaluru, Karnataka 560029

Chennai

8th Floor, Smartworks, Olympia National Tower, Block 3, A3 and A4, North Phase, Guindy Industrial Estate, Chennai 600032

Pune

7th Floor, IT-7 Building, Qubix Business Park Pvt. Ltd. SEZ, Phase - 1, Hinjawadi, Pune 411057

Mumbai - Thane

AWFIS 1st Floor, Nehru Nagar, Wagle Industrial Estate, Thane West, Thane Maharashtra 400604

Mumbai

7th Floor, Smartworks, Times Square, Tower C, Andheri Kurla Road, Marol, Andheri East, Mumbai 400059

Pune

6th Floor, Smartworks, Pan Card Club Road, Baner, Pune 411045

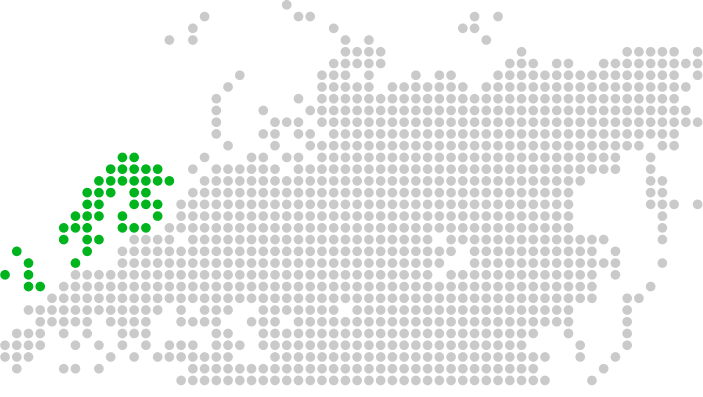

Europe

2 Locations

London

c/o SPACES, 12 Hammersmith Grove, London W67AP, UK

Ireland

Grove, Fethard, Co. Tipperary, E91 E282, Dublin, Ireland

North America

7 Locations

Canada

55 York Street, Suite 401 Toronto, ON, Canada M5J 1R7

Mexico

Tomas A. Edison 1510-201 Ciudad Juárez, Chihuahua, Mexico 32300

Seattle

4030 Lake Wash Blvd NE, STE 210, Kirkland, WA 98033

Troy

6915 Rochester Road Suite 300 Troy, MI 48085

Sunnyvale

1248 Reamwood Avenue Sunnyvale, CA 94089

New Jersey

343 Thornall Street Suite 720 Edison, NJ 08837

Dallas

5851 Legacy Circle Suite 600 Plano, TX 75024