As a CFO, Finance Manager, Accounts Payable/Receivable Manager, or any other role involved in financial operations, you understand the importance of efficiency and accuracy in managing finances. The good news is that technology has made financial management easier than ever before, and one essential tool for streamlining your financial processes is invoice software.

According to a Business Insider report, enterprises that use digital payables solutions save a whopping 81% in processing costs and experience 73% lower processing cycles. Invoicing tools let you create invoices, send payment reminders, and receive payments, among other possibilities. In this article, we look at invoice software as a solution for seamless financial operations. We discuss the features to look for and the benefits of adopting this tool for your business.

Benefits of Using Invoice Software

Invoice software offers a wide array of benefits that enhance efficiency and save valuable time for finance professionals like yourself. Some of these benefits include:

- Faster Payments: Creating and customizing professional invoices that represent your brand can significantly improve your payment collection process, getting you paid faster.

- Minimized Late Payments: Automated payment reminders ensure your customers pay on time, reducing the hassle of chasing late payments.

- Improved Payment Tracking: With payment tracking capabilities, you can effortlessly monitor and manage your incoming payments, avoiding missed payments.

- Streamlined Financial Operations: By automating tasks and reducing manual efforts, invoice software frees up time for you to focus on critical financial decisions.

- Error Reduction: The software ensures accurate and error-free invoices, eliminating duplication and minimizing potential errors.

- Simplified Payment Processing: Some invoice software solutions offer integrated payment gateways, making it easy for your customers to pay online, streamlining the payment process.

For a streamlined process, a well-organized bookkeeping spreadsheet is crucial for small business bookkeeping, providing a backbone for tracking income, expenses, and other financial data. It helps monitor financial health by allowing easy entry of income and expense details, categorizing transactions, and reconciling accounts.

When integrated with invoice management software, the small business bookkeeping spreadsheet becomes even more powerful, enabling seamless data synchronization between the two systems. This streamlines the record-keeping process, saves time, and minimizes errors or duplicate entries. The harmony between invoice management and a small business bookkeeping spreadsheet facilitates precise financial records, well-informed decision-making, robust financial reporting, and simplified adherence to tax regulations and audit requirements.

Features of a Good Invoice Software

A good invoice software serves as the cornerstone of a streamlined financial process, offering a plethora of features that enhance accuracy, save time, and improve financial processes. From automated invoice generation and customization to seamless integration with accounting systems, payment gateways, and reporting functionalities, a robust invoice software can significantly elevate a business's invoicing process.

Let’s delve into the key features that define a superior invoice software, empowering businesses with the means to optimize their financial operations and bolster their bottom line.

Invoice Generation

At the very least, invoice software should let you generate invoices. This can be either from scratch or templates that the software provides. In addition, you should be able to customize the invoices to reflect your brand. This means including your logo, business name, and other elements that represent your business in the invoices.

Multi-Currency Support

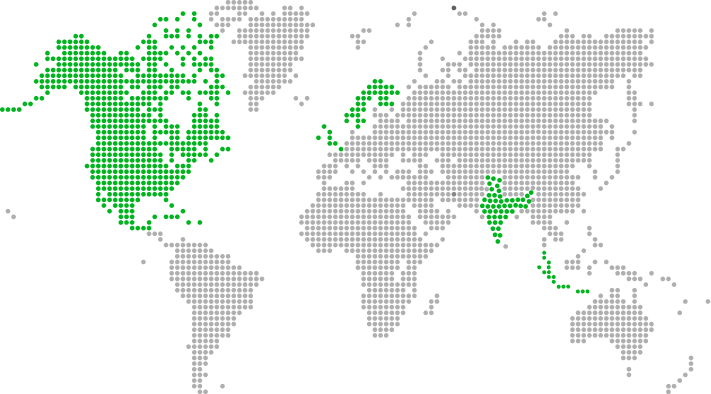

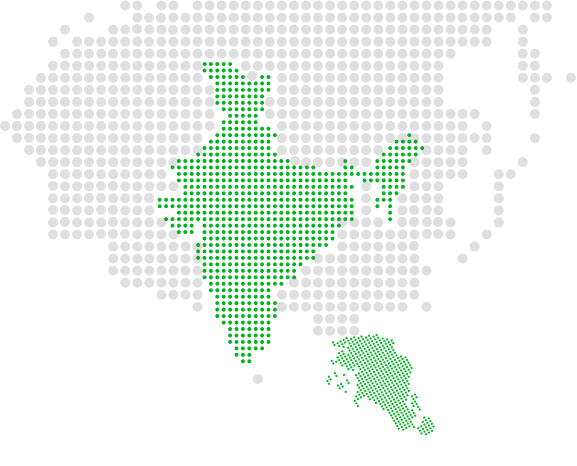

Receiving payments in different currencies is common for today’s businesses. It is important that the invoicing software of your choice has a multi-currency feature. This will help you with billing, receiving payments, and managing taxes where different currencies are involved. In addition, the software should offer you the ability to process payments. With the software, you should be able to create an online portal for receiving and processing payments.

Integration with Key Business Systems

Your invoice software should be able to integrate with your core business systems, such as accounting, banking, e-commerce, and inventory. You should also be able to integrate it with your client databases and timesheets for easier invoicing. The advantage of systems integration is that it helps sync data from different departments, providing a single source of truth for your business needs. This streamlines your operations by eliminating repetitive tasks and saving you time and money.

Automated Payment Reminders

As said earlier, one of the benefits of using invoice software is minimizing late payments. You should look for invoicing software that sends automated reminders to your customers strategically to encourage them to pay faster and on time. This is possible with the payment tracking capabilities of your software. The software should be able to track payments to help you send reminders and receive payments on time.

Reporting

Management reports are crucial for deriving useful insights for running a business. With invoice management software, you should be able to generate reports such as accounts payable reports, and customer payment trends, among others, to help you make informed decisions. In addition, you should be able to generate tax reports with the system. This helps streamline your tax reporting and filing.

The Path Ahead for Invoice Software

The emergence of generative AI is set to reshape invoicing software, automating data entry, personalizing content, and providing predictive insights. This technology will further simplify automated extraction of information from documents, enhance customer engagement through personalized invoicing, and empower businesses with predictive analytics for smarter decision-making.

Additionally, Generative AI can bolster security by detecting fraudulent activities, while the potential for conversational invoicing assistants offers seamless interactions and efficient issue resolution. In essence, the integration of Generative AI into invoicing software promises heightened efficiency, strategic value, and enhanced user experiences, revolutionizing the way businesses manage their financial processes.

Experience Xoriant X·CELERATE Invoice for Your Business

Xoriant X·CELERATE Invoice is a powerful invoice software that streamlines the invoicing process and offers features like tracking payments, sending automatic reminders, and managing invoice statuses, ensuring accuracy and efficiency in generating invoices. Experience the power of X·CELERATE Invoice and elevate your brand with its intuitive interface and brand personalization options. X·CELERATE Invoice also lets users to customize invoices to represent their unique brand identity. With its user-friendly interface, it allows users to easily incorporate their logo, business name, and other essential elements, creating a professional and cohesive image.

Way Forward

In conclusion, adopting invoice software is a game-changer for your financial operations. From faster payments to streamlined bookkeeping, this tool empowers finance professionals and business owners to make informed decisions and improve the bottom line. So, take advantage of the benefits offered by invoice software and stay ahead in the ever-changing world of finance.

View Previous Blog

View Previous Blog