Let’s architect the Future of FinTech with Digital as the Cornerstone

Tell us your Industry Challenge

Futurifying Finance

Financial firms are dealing with big changes. They must save money, manage risks & invest in digital services for delivering deliver hyper-personalized financial services.

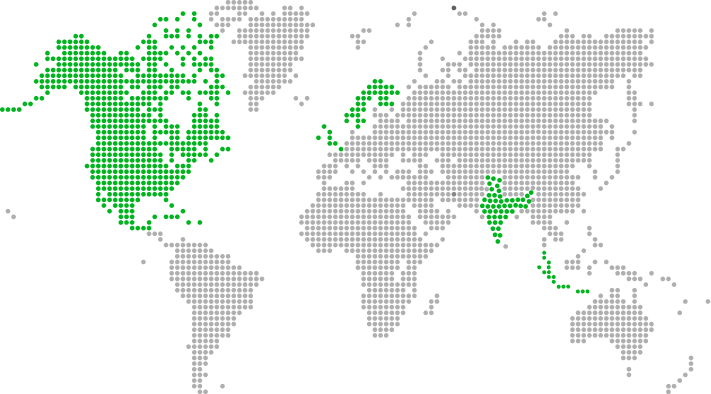

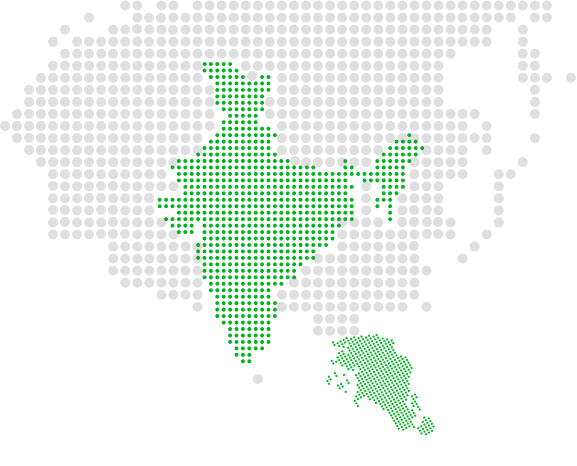

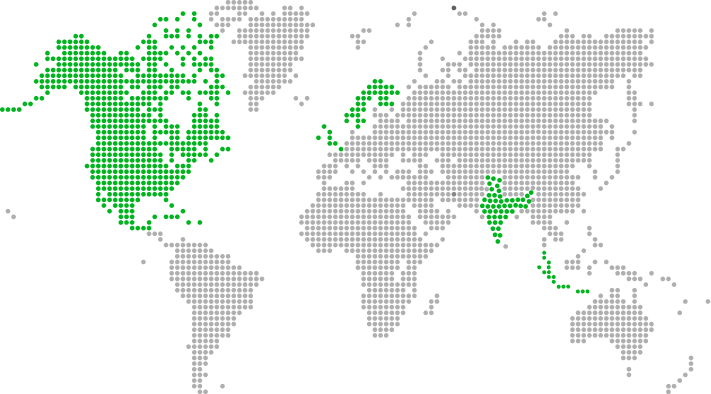

Xoriant brings together strong engineering expertise and the latest technology know-how to drive digital transformation and update applications. We are here to support the world's leading financial services providers in achieving better revenue, operational efficiency, and a competitive advantage. Our commitment lies in helping these providers grow, cut costs, and stay ahead in the market. By infusing innovation into everything we do, we're playing a key role in shaping a brighter and more advanced future for the financial industry.

Featured Insight

22+ Years

of banking and financial sector expertise

9 of Top 10

Global banks trust us as an engineering partner

Upto 95%

Reduction in OFAC compliance errors

Those We Serve

Technical Edge Driving Digital Financial Services

Our Success Stories

Talk To Our Experts

Keeping You Updated

BFSI Sector - Questions frequently asked

How do Global Transaction Banking Solutions contribute to improved financial decision-making and risk management?

Global Transaction Banking Solutions contribute to improved financial decision-making and risk management by providing real-time transaction visibility, advanced data analytics for trend identification and data-driven decisions, efficient cash management for optimized liquidity, and robust fraud detection and prevention measures to minimize financial risks. These solutions also offer

What are the IT Solutions for Banking and Finance?

IT solutions for banking and finance encompass a wide range of technology applications and systems that cater to the unique needs of the industry. These solutions include core banking systems for transaction processing, CRM software for managing client interactions, online and mobile banking platforms for convenient access, payment gateways for secure transactions, fraud detection and anti-money laundering (AML) solutions, risk management software, data analytics and business intelligence tools, blockchain and distributed ledger technology (DLT) for secure and transparent transactions, RPA for process optimization, and AI and ML for personalized customer experiences and risk assessment.

How is technology used in finance?

- Online Banking and Mobile Banking Apps

- Digital Payments and Contactless Transactions

- Financial Analytics and Business Intelligence

- Automated Trading and Robo-Advisors

- Blockchain Technology for Secure Transactions

- Risk Management Tools and Real-time Monitoring

- Regulatory Technology (RegTech) for Compliance

- Fintech Solutions for Innovative Financial Services

- Cybersecurity Measures to Protect Financial Data

Which technologies are used in banking software?

- Core Banking Systems

- Customer Relationship Management (CRM) software

- Online and Mobile Banking Solutions

- Payment Gateways and Processing

- Fraud Detection and Prevention Systems

- Anti-Money Laundering (AML) Solutions

- Risk Management Software

- Data Analytics and Business Intelligence Tools

- Blockchain and Distributed Ledger Technology (DLT) for secure transactions

- Robotic Process Automation (RPA) for process optimization

- AI and ML for personalized customer experiences and risk assessment.

What are the benefits of corporate banking?

The benefits of corporate banking are numerous and crucial for businesses. Corporate banking services provide companies with a wide range of financial solutions, including corporate loans, working capital financing, trade finance, treasury management, and cash management services. These services facilitate smooth day-to-day operations, support business expansion, improve liquidity management, and enhance financial stability. Additionally, corporate banking offers personalized financial advice and expertise, fostering strong relationships and strategic partnerships that can contribute to the long-term success and growth of businesses.