Bank Accounts – ERP Integration

Introducing Xonnect - Your Key to Banking Transformation for Enhanced Efficiency and Customer Satisfaction.

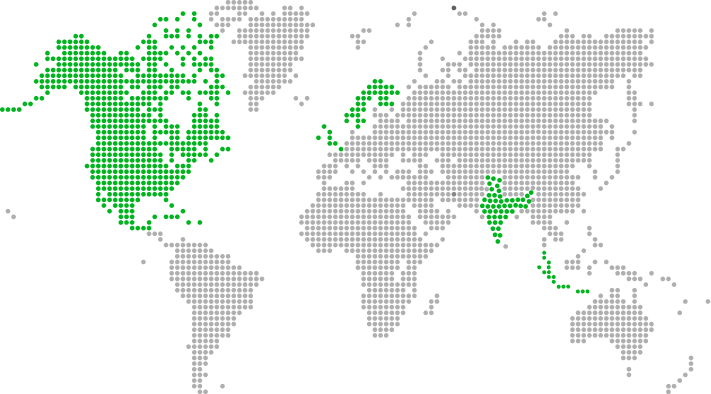

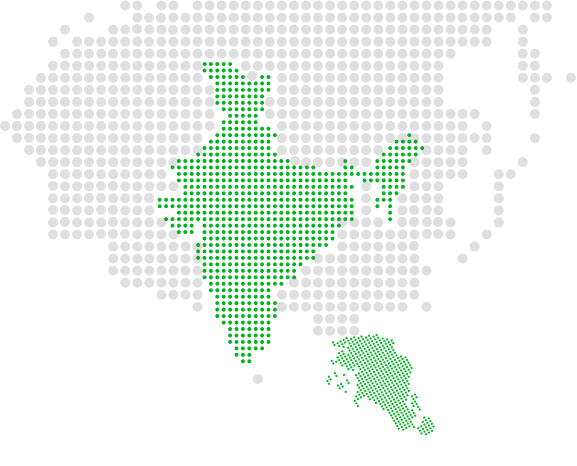

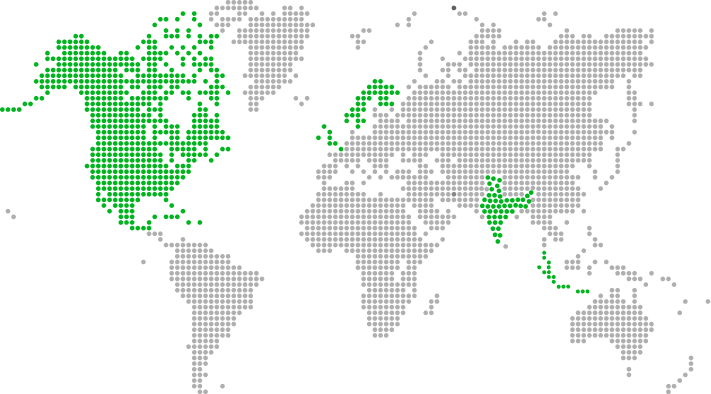

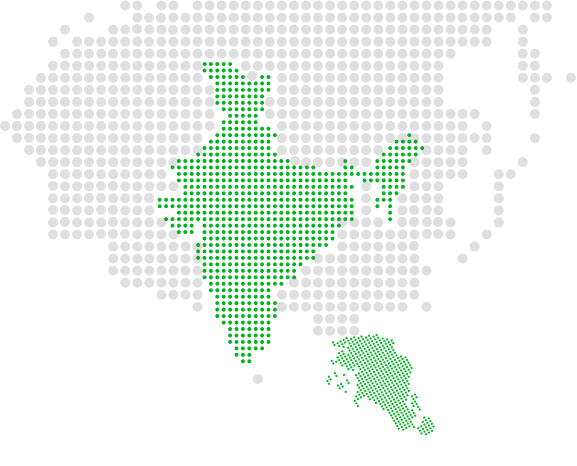

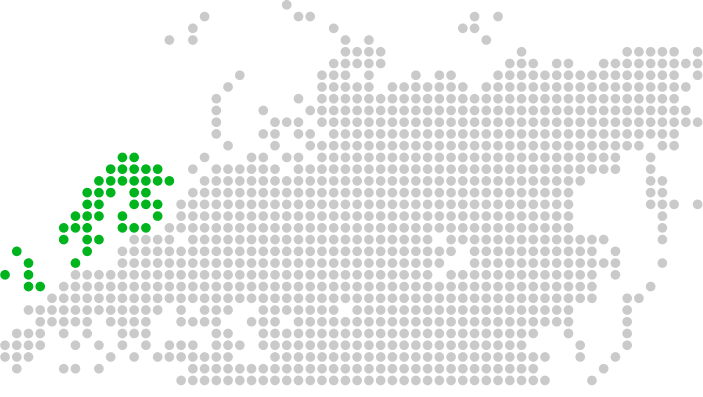

Xonnect, is a composable banking solution by Xoriant that helps business customers by seamlessly connecting their business systems directly to their bank accounts. The direct access to customer data and systems, enables banks to rapidly deliver innovative digital experiences, fulfill the digital ambitions of their customers, and facilitate automation while replacing manual processes.

Xonnect's Power Capabilities

Ingest, Transform, Feed

Unlocking Banking Excellence with Xonnect: Key Benefits

Onboard customers in a matter of days with full lifecycle enablement and support services from Xoriant

Drive innovation, ensure customer delight and uncover additional revenue streams.

Reduced maintenance cost for multiple ERP integrators and business system connectors.

Digital Experiences Banks can Deliver with Xonnect

Keeping You Updated

Xonnect - Questions frequently asked

What is Xonnect, and how does it relate to Bank ERP Connectivity?

Xonnect is a fully composable banking solution by Xoriant that connects businesses directly to their bank accounts through seamless ERP connectivity. Xonnect is compatible with all the leading ERPs available in the market today.

How does Xonnect benefit banks?

Xonnect enables banks to rapidly onboard customers in a matter of days, deliver innovative banking experiences, discover additional revenue streams, and reduce maintenance costs through seamless ERP connectivity while managing multiple ERP connectors.

What digital experiences can banks provide with Xonnect?

Banks can offer real-time access to account balances, automate balance reconciliations, automate payments for working capital loans and invoices, and streamline the end-to-end trade finance process, among other digital experiences.

How does Xoriant assist banks in implementing customer onboarding through the use of Xonnect?

Xoriant provides expert guidance and recommendations to facilitate the complete implementation and integration of Xonnect. Additionally, they offer technical assistance and troubleshooting support to ensure seamless operations.

Disruptions becoming a blocker to your Desired Digital Future?

Let’s address them with Digital Engineering