The race is on! While traditional Mortgage Loan Originators are rushing to complete bold modernization projects before the rates increase, cloud-native startups are nipping at their heels.

On the front lines, you need to provide quick and easy digital customer experiences. That means manual processes are out, one-stop loan applications and self-service bots are in. However, at the infrastructure level, modernization is more complex.

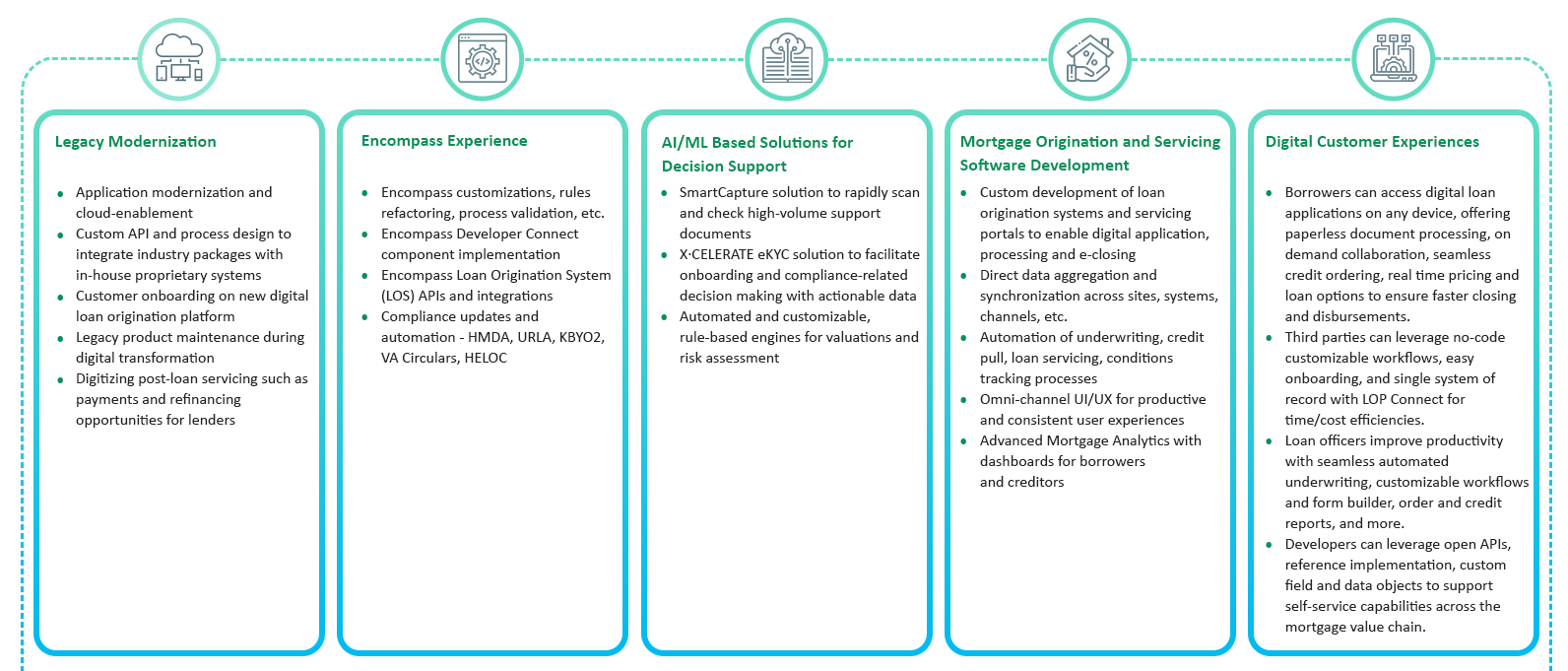

An integrated digital loan platform and open APIs can help you achieve this level of transformation. However, if your organization lacks the expertise, you’re at a competitive disadvantage. You need a trusted partner who knows fintech inside out.

Digital Product Engineering Services & Solutions for Mortgage

Digital Product Engineering Services & Solutions for Mortgage

WHY XORIANT ?

Xoriant’s Mortgage Industry Team has deep experience working with retail and direct lenders, as well as leading mortgage ISVs. Because we understand the market, we’ve been able to develop innovative tools, frameworks, APIs and automation solutions to accelerate Encompass implementations, ensure compliance, and reduce Loan Origination time and costs. On the front end, Xoriant engineers focus on continuously improving the borrower experience and agent productivity with modern UI/UX design and easy-to-use self-service portals. Whatever the need, our Mortgage Industry Team has a track record of delivering results.

Automated URLA compliance initiative and reduced costs.

50+ integrations, developed the interface, web accelerator and reference implementation for mortgage platforms.

Helped build next generation LOS with mortgage platform leader that processes 35% of all mortgages in the USA.

Partnered for 10+ years leveraging team of 500+ engineers.

Learn about Xoriant Frameworks for Advanced Product Engineering

Trends Title

Explore Industry Trends and Insights

Explore Industry Trends and Insights

Explore the exciting opportunities – and challenges – new tech presents lenders and ISVs today.

4x Loan Processing Speed. Optimized Cloud Costs. Automated Workflows Accelerate Loan Service Ordering, Packaging and Delivery.

Automation in Underwriting, Workflows and Forms Management Accelerated URLA, HMDA, TILA, FHA and Other Compliance.

Industry experts uncover insights to accelerate digital transformation and innovation, as well as increase efficacy of KYC usability, compliance, and trend initiatives.

Xoriant helped one of the leading cloud-based platform provider for the mortgage finance.

To pass the digital experience test and thrive in a hyper-competitive market, ISVs with a footprint in the mortgage lending space need to build products and platforms that offer end-to-end digital capabilities.

The key to maximizing your cloud investment is knowing where and how to use it.