Modernization of ISV products has become a necessity across all industries and sectors. This is even truer in the financial services space given the recent economic disruption and its impact on borrowers’ needs and lenders’ capabilities.

Post-pandemic consumers and businesses have become reliant on digital apps, interfaces, and devices and expect their vendors to provide digital experiences similar to their mobile apps, Facebook, Amazon, etc. For example, in a recent Finastra survey, 63% of customers said they’d prefer to apply for a mortgage through a digital channel.[1] Borrowers are nervous enough; they don’t want to be bogged down with endless forms and manual processes to get loans, make payments, or communicate with their lender. They want a variety of personalized loan offerings and payment options, and rapid processing of every step in the loan lifecycle. However, many existing lending and mortgage products still have a long way to go before passing the ‘digital experience’ test.

Several roadblocks prevent them from becoming digital-first. To begin with, there are increasing concerns about the security and compliance of evolving digital platforms. Second, legacy LO platforms cannot scale to handle high-volume requests and transactions if the stacks are not modernized and integrated with strategic ecosystem players. Third, the platforms have to be agile and nimble enough to meet the changing needs of customers, as well as economic and market drivers.

To pass the digital experience test and thrive in a hyper-competitive market, ISVs with a footprint in the mortgage lending space need to build products and platforms that offer end-to-end digital capabilities.

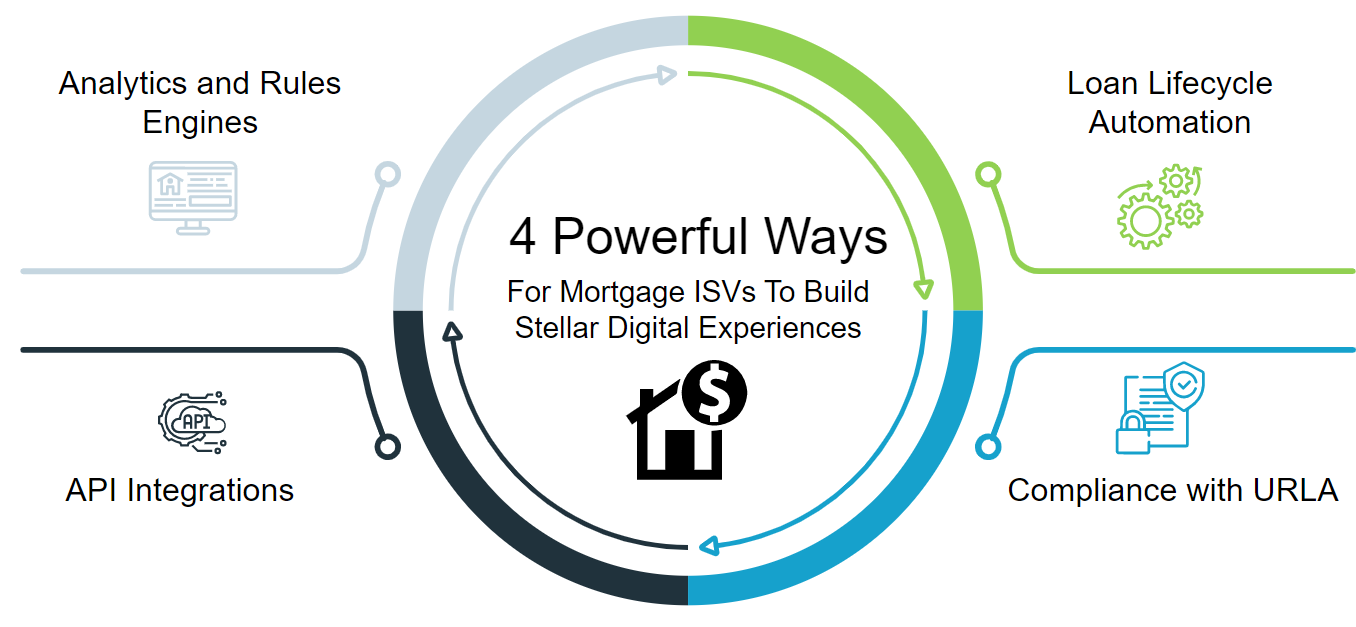

How Mortgage ISVs Can Build Stellar Digital Experiences

1. Analytics and Rules Engines

The lending and mortgage industry is heavily regulated and rules-based. For example, a loan application must comply with several rules just to be considered eligible. These rules can change frequently, causing delays and manual rework if the lender is relying on legacy systems and processes. Taking into consideration the expectations of borrowers for faster processing times, The application goes through a gauntlet of reviews, risk evaluations, and often re-keying to incorporate updates and changes over the typical four-to- six week LO cycle.

Fintechs, cloud-based startups, and agile online MLOs have built or leveraged products and technologies that enable (almost) straight-through loan processing, thus gaining a competitive advantage. This is why ISVs need to integrate an automated, rules-based engine in their products to support automatic compliance and rapid, data-driven decision-making. Rules-based engines bring order and consistency to any business process. They can help to profile and segment customers and cross-sell products; they can calculate credit scores and monitor and change credit rules, reducing processing time. Also, as most rule-based engines are built on SOA architecture, they can be used as a central rule repository across all services and lines of business. This not only facilitates risk management, but it also allows non-programmers to change business logic in a business process management system without writing code.

2. Loan Lifecycle Automation

The loan lifecycle goes through multiple steps such as pre-screening, application review, underwriting, credit decisions, loan funding, etc. Every application has to be scrutinized carefully at each stage before progressing. Given the complexity of the process, maintaining accuracy throughout can be a huge challenge, especially when legacy systems and siloed data sources are involved. These systems will require some level of manual intervention, adding time, complexity, and a propensity for error.

ISVs must consider updating their products and platform to allow automating the loan lifecycle to simplify the process, improve accuracy, and reduce the turnaround time for processing loans. Automated rules and digitized processes, deep integrations, and more transparency could provide a competitive advantage over the growing field of competitors. Automation can also help standardize the processes required to handle large volumes of applications without compromising compliance. Also, as manual tasks get automated, LO teams can focus on more important tasks that need human cognitive interventions.

3. Compliance with URLA

Recently, Fannie Mae®, along with Freddie Mac and other industry stakeholders, redesigned the Uniform Residential Loan Application (URLA or Form 1003) to improve the digital lending experience and streamline the application process. It was designed to seamlessly integrate with digital workflows and reduce costs and risks. URLA requires 48 new data points to ensure there is no discrimination in the process. However, legacy systems might not be able to capture these new requirements, leading to unnecessary delays in implementation. Ready or not, the only viable option is an overhaul of traditional workflows and processes and digitalization of the customer journey – from loan requests to loan approval, distribution, and beyond. To ensure URLA-compliance, ISVs have yet another pressing reason to transform their digital lending products.

4. API Integrations

Mortgage loan customers require personalized options and rapid service delivery and neo-banks and fintechs are able to offer that. Legacy platforms do not possess the capabilities to provide this type of differentiated mortgage experience. Given that data is stored in disparate systems and silos, traditional lending platforms cannot keep pace with the constant demand for documentation, scoring, records, etc. Hence, ISVs need to think of ways to embed agility into their products and platforms. One way is to provide API integrations with third-party products and services. They could then create an interconnected and innovative ecosystem able to provide on-demand, personalized solutions, and support across the entire loan lifecycle. In fact, APIs may hold the key to building MLO ecosystems that will allow lenders to keep pace with changing market and customer demands ― and stay ahead of the competition.

Conclusion

ISVs now realize the need to modernize their mortgage and lending products to provide seamless digital experiences to MLOs and their customers. However, they need to facilitate upgrades without hampering the experience of existing customers. To do that, they must partner with advanced engineering experts who specialize in building powerful and comprehensive e-mortgage lending solutions.

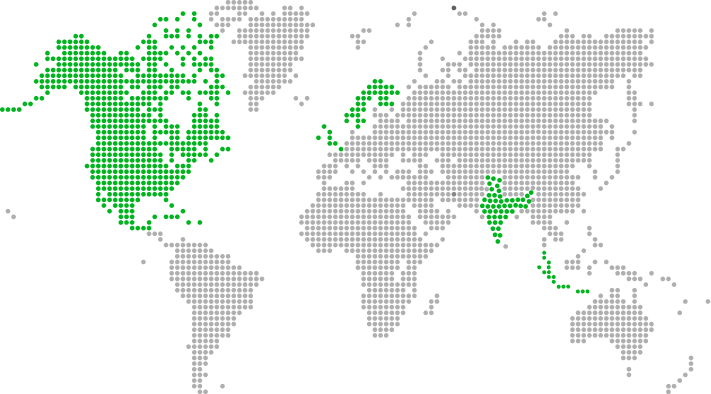

At Xoriant, we help ISVs build competencies in the digital lending and mortgage space by:

- Modernizing legacy technologies with scalable and future-ready solutions

- Implementing AI and analytics to improve decision making, reduce risk, and more

- Ensuring regulatory compliance across the MLO lifecycle

- Streamlining and automating loan lifecycle solutions

Take the example of a leading mortgage origination solution provider that supported thousands of lenders and over 50,000 applications per month. Their legacy system had limited scalability, was difficult to maintain, and lacked a user-friendly interface. We re-architected their application and transformed it from a product to a platform. This enabled the ISV to build custom loan applications quickly and deploy them on the cloud.

Discuss your vision of creating digital experiences for Mortgage and Lending Products and Platforms with Xoriant Experts, write to: PE@Xoriant.com

References

1. Finastra Blog: Redesigned URLA refines borrower and lender experience

View Previous Blog

View Previous Blog