Client Background

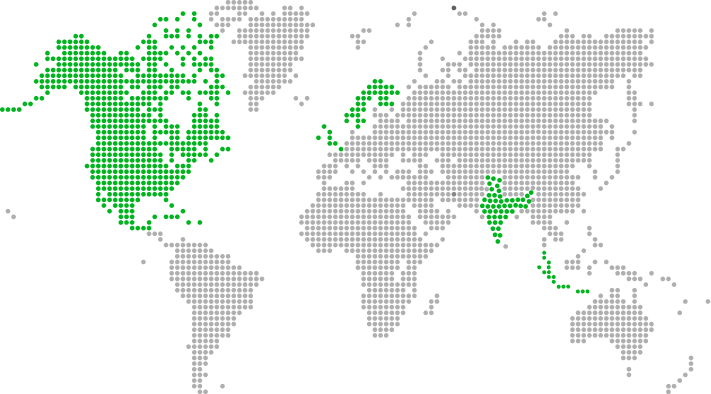

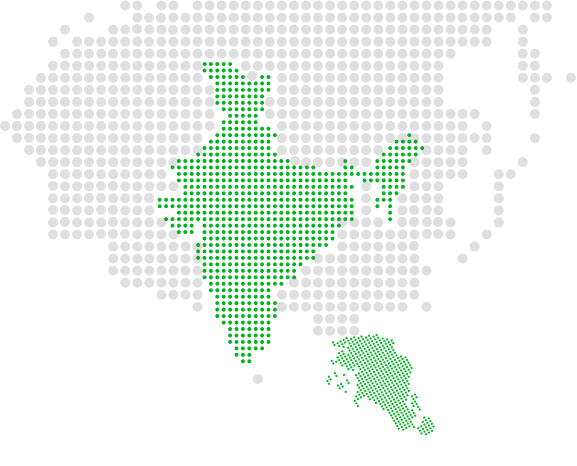

- Our client, a leading Fortune 100 global diversified financial service holding company.

- Being a global bank, the client had to comply with the regulations laid down by the federal agencies - Federal Reserve Board (FRB) and Office of the Comptroller of the Currency (OCC).

- These included FRB’s Comprehensive Capital Analysis and Review (CCAR) and OCC’s Dodd-Frank Act Stress Test (DFAST), a semi-annual exercise intended to assess the large bank holding companies (BHCs) risk profile and capital adequacy even at times of adverse economic and financial stress.

- Data sourcing from different demographics and business units was manual, time-consuming, and tedious through email communications. Non-compliance to CCAR reporting led to high-cost implications.

Xoriant Solution

- Xoriant combined engineering rigor with next-generation technology expertise to make the regulatory reporting process smooth.

- Designed platform architecture for reports management, process orchestration & workflow.

- Developed the platform for enterprise-wide regulatory report specific data aggregation, submission & management.

Key Benefits

- Reduced 90% manual errors and achieved 100% accuracy level in submitted data.

- Delivered single day report submission irrespective of report type.

- Reduced time taken for report generation & submission.

View Previous CS

View Previous CS